Student Finance – Explained

It’s important to note that the information on this page refers to Plan 5 loans, there are other plans containing different loan and repayment amounts, but this information is correct as of March 2024, and applies to students starting an HE course after September 2023 (to confirm, yes it also refers to you if you’re starting a course in academic year 2024/25).

The short clip below (which was made before the most recent changes) describes how the student loan system works in plain terms.

How do people pay for university courses and what about their living costs?

To cover the costs of higher education in England, there are two types of student loan available:

Tuition fee loans

Tuition fee loans are there to cover the cost of the course. Currently, universities and colleges are able to charge up to a maximum of £9,250 per year for a typical full-time higher education course. Anyone who meets the eligibility criteria can apply for a tuition fee loan to cover the cost of their course. You would apply for the entire cost of your tuitions fees, and it’s paid straight to the university or college where you study.

Maintenance loans

Maintenance loans are available to help with the everyday costs of living, for example: accommodation, food, utility bills and socialising etc.

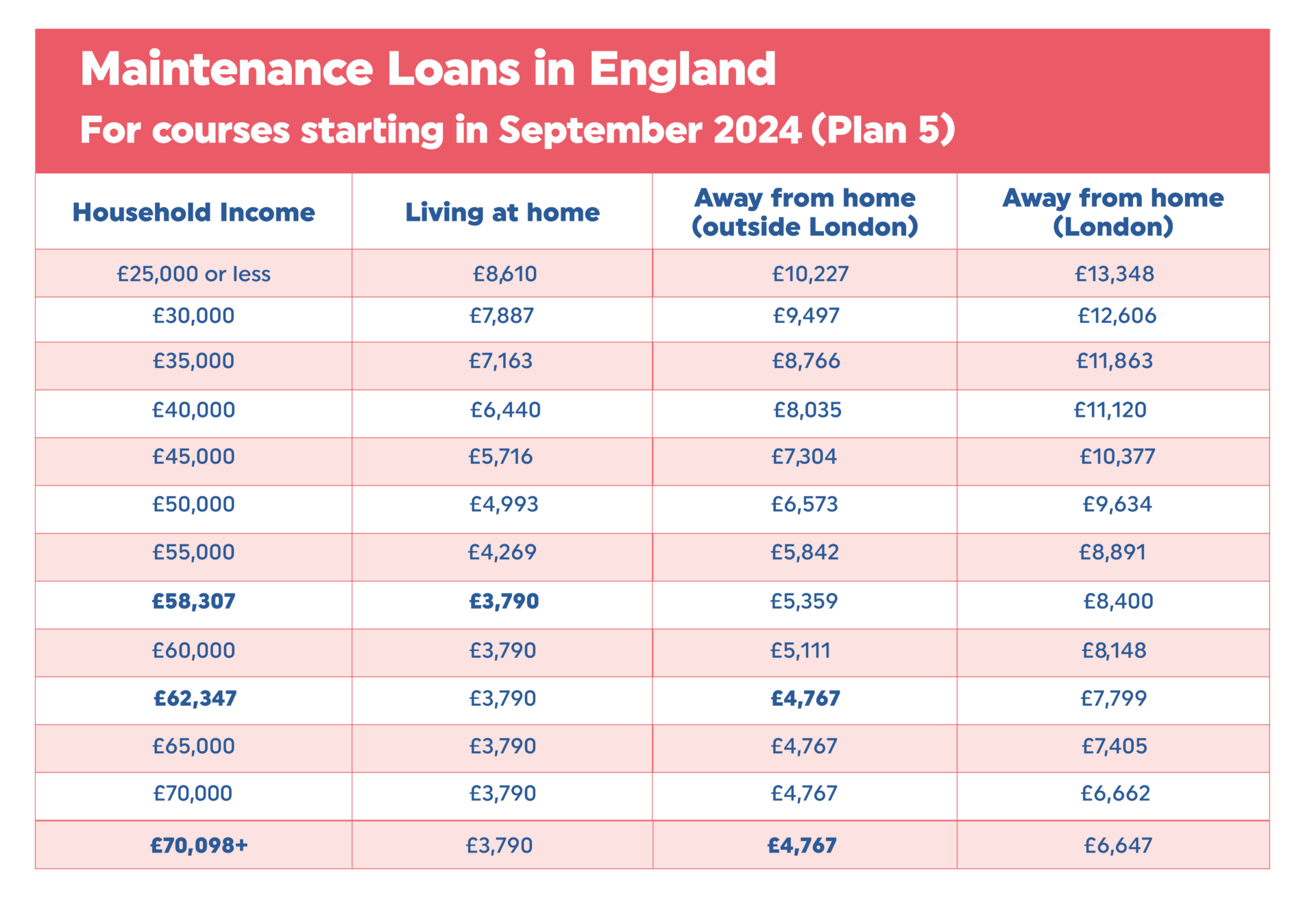

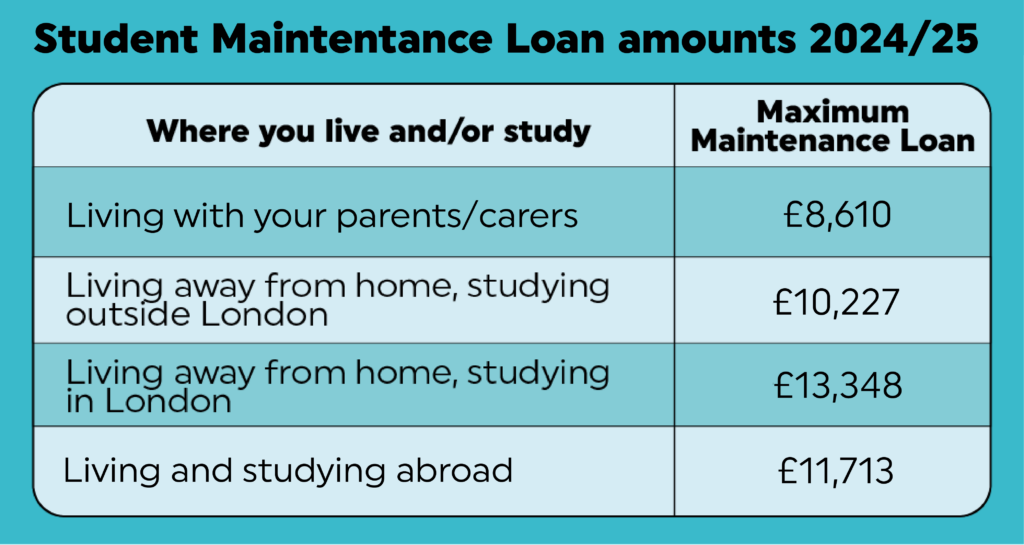

For maintenance loans, the amount you can borrow depends on your family’s household income and when you’ll live, whether staying with parents or carers or moving out. If you’re going to university in London, the maximum loan amount available is higher to account for the higher cost of living in the capital.

How much will you get?

If the household income is more than £25,000, the amount you will be eligible for will be lower. Due to the higher household income, it is expected that parents or carers will help. Often students choose is to work part-time to help support their living costs. See the table below to work out how much you might be entitled to:

The household incomes in bold represent the upper earnings thresholds for the parents of students in each living situation. Students with parents earning above these thresholds will receive the minimum Maintenance Loan for someone with their living arrangements:

£3,790 if you live at home and your household income is £58,307 or above.

£4,767 if you live away from home and outside London, and your household income is £62,347 or above.

£6,647 if you live away from home and in London, and your household income is £70,098 or above.

The earnings listed in the table above are just examples, the Maintenance Loan you receive will be calculated using your exact household income. To find out exactly how much your young person could expect to receive use this online student finance calculator.

Who can apply for these loans?

Generally speaking, if you’re a UK national, or have ‘settled status’ in the UK, you can apply for tuition fee loans and/or maintenance loans. For specific eligibility criteria, we recommend checking out this page: Student Finance – Who Qualifies?

For most courses, applications should be made by the end of May in the year that the course will begin; however, it is possible to apply for a loan up to nine months after the course start date.

If your parent, carer or partners’ income drops by 15% or more compared to the tax year that would normally be used, you can apply for a ‘Current Year Income assessment’. Student Finance England have updated their process to reflect changing circumstances (for example this also applies if your parent or partner has retired or got a different job), you can ask them to calculate the student finance based on your estimated income for the current tax year instead. Find out more here.

Watch: Student Finance explained or listen to our HE Knowledge Hub Podcast – Student Finance 2024, where we talk to someone from the Student Loans Company England.

“…But HE isn’t good value for money…”

The expense of HE is always given as the number one reason not to progress into it, and most of the time we focus on showing that it’s worth the expense. But, actually what we don’t highlight as much is what you can expect to receive whilst studying, or in other words, why is it worth the money. HE gives you access to cutting edge and industry standard technology, the expertise and support of industry leaders, plus the networking opportunities this can bring. The following films highlight that studying at HE gives you the best access to this, and more:

How and when does it get paid back?

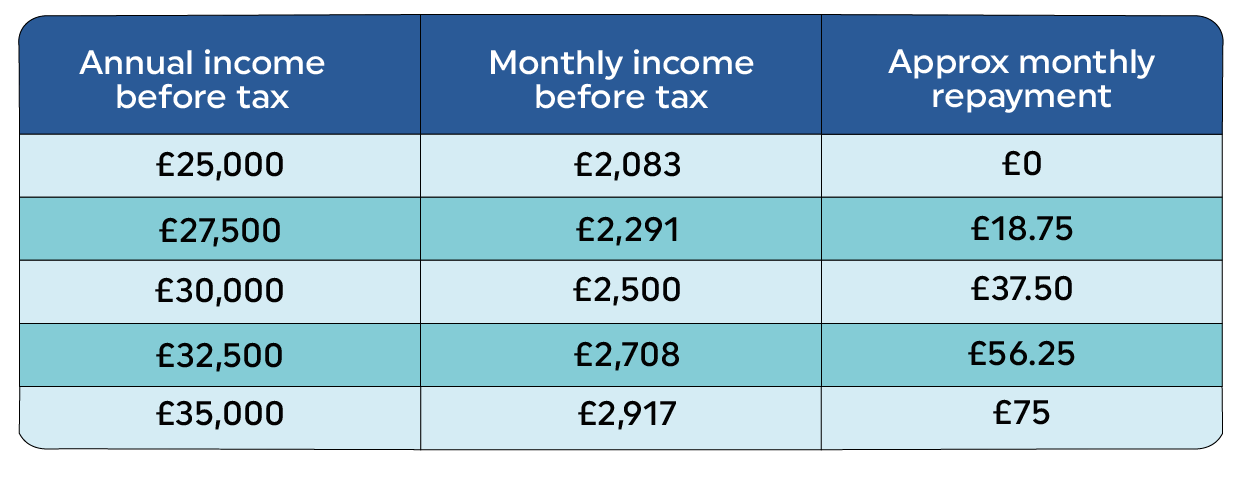

When it comes to repaying these loans, both are added together (that’s if you’ve borrowed both). Repayments start in the April after you have finished your studies and when you are earning over a certain amount. The threshold currently stands at £25,000.

Repayments are not linked to how much was borrowed, they are based on how much you earn:

- If you earn under the threshold, you don’t repay anything until you’re earning above it.

- If you never earn above the threshold, you’ll never pay anything.

- If you do earn over the threshold, you’ll repay 9% of whatever you earn over it.

After 40 years, whatever amount is outstanding gets written off.

How much are monthly repayments?

The table below shows approximate monthly repayments for a range of salaries at the current threshold of £25,000.

Visit: Quick Start Finance Guide for the most up-to-date figures.

How does interest work on student loans?

Like the repayments, interest is linked to how much you earn, but it doesn’t change the amount you repay each month. This article by Martin Lewis (from last year) explains the topic of student loan interest really well.

Financial support for eligible students

There’s a range of financial support for eligible students, like other funding amounts these funds are subject to change – for example the Disabled Student Allowance (DSA). Use the links below to find out more:

Download the free money manager app Blackbullion to help with budgeting and managing spending.